February 28, 2024

How to claim car rental business tax deductions: 8 tips to know

One car sharing subject that no one wants to discuss (but everyone needs to)?

Taxes.

If you’re running a car sharing business — either as a one-vehicle side hustle or a fleet-based operation — you need to consider how that income plays into your yearly taxes. Depending on how often you share your vehicle(s) with others and how much you spend on maintenance, you could owe more to Uncle Sam than you expected.

But what are your tax responsibilities when renting your car out?

Let’s walk through how to claim income from car sharing on your tax return and discuss ways to offset that tax bill through potential deductions for money you spend on your car sharing business.

1. Determine whether your car sharing counts as a business

The first thing you must do is figure out whether your car sharing counts as a business. That’ll help determine whether your income counts as business or regular income. The best way to do that is to ask three basic questions:

- Is your operation a trade or business?

- Did you materially participate?

- Is your business a passive activity?

Is your operation a trade or business?

You may consider your car sharing operation a trade or business if you carry it out with the intention and expectation of making a profit. If you consistently rent out your car, invest time in managing the operation and make decisions that increase profitability, there’s a safe bet that it’s a business.

Occasionally renting out your car without invested time or effort might make it a hobby. The IRS uses factors like how you carry out the activity, your expertise and your invested time or effort to determine whether it’s a business or hobby.

Did you materially participate?

Material participation involves regular, continuous and substantial involvement in the business. Actively managing bookings, maintaining the vehicle and marketing it are all examples of material participation.

If you have minimal involvement and list your car on a sharing platform that handles most operational tasks, there’s a good chance you may not be materially participating. The IRS looks at these seven factors when gauging material participation.

Is your business a passive activity?

The IRS considers a business a passive activity if you don’t materially participate in its operation during a tax year. That means if you don’t regularly get involved in managing the process, it might be passive.

Why is this important? Passive activities are subject to different tax rules. You usually can’t offset non-passive income with losses from these activities. This might limit your ability to deduct car sharing expenses from other income sources (like your day job).

In most cases, it makes sense to classify your car sharing earnings as business income rather than nonbusiness income. This lets you take tax deductions on any business-related expense. That, in turn, lowers your taxable income and the amount you must pay in income taxes.

For example, say you earned $2,500 throughout the year but spent $800 on allowable, relevant expenses. Instead of being taxed on $2,500, you would only pay taxes on $1,700. Let’s say you are firmly in the 22% federal tax bracket. This reduction in taxable income through qualified business deductions could lower your tax bill by $176.

Sole proprietorships vs. limited liability companies (LLCs)

Depending on how expansive your car sharing business becomes, it might make sense to transition from a sole proprietorship to a limited liability company (LLC). In a sole proprietorship, you and your business are the same entity. That means any debt your car sharing company incurs or lawsuit it faces extends to you and could put your personal assets at risk. With an LLC, you have some protection. Your personal assets are not eligible for seizure to satisfy business debts or liabilities.

Taxation rules and schedules also differ. As a sole proprietor, you report your business income and losses on a personal tax return. The business itself is not taxed separately. With LLCs, you can choose to be taxed as a sole proprietor, a partnership or a corporation.

2. Keep necessary records for tax deductions

No matter what kind of business you operate, you must keep the necessary documents for tax deductions. Proper bookkeeping is vital to ensure you accurately file your taxes. You should always include the following documentation in your records:

- Dates of car usage: Maintain a log of all the dates your car was used for business purposes, including transport to and from the pick-up and drop-off location. Specify which dates customers rented the vehicle too.

- Mileage logs: Keep detailed records of mileage for each trip when the car was rented. Include the starting and ending mileage and the dates.

- Number of days used: Track the total number of days your car was rented. This helps distinguish between personal and business use.

- Time spent on business activities: Document the time you spend on car sharing-related activities, including marketing, booking, maintenance and customer service.

- Maintenance records: Because they’re a deductible expense, keep a thorough history of your car’s maintenance and repair work. This includes oil changes, tire rotations, brake inspections and repairs or improvements. Include the date, nature of the maintenance and the cost.

- Financial records: Keep all income records you receive from the car sharing platform and your expenses. That includes receipts for gas, insurance, car washes and other costs that relate to the business.

- Contracts and agreements: Keep copies of all contracts or agreements related to your car sharing platform or individual customers.

How long should you keep records? Most experts recommend keeping records for up to three years in case of an IRS audit. Store all documentation in a safe, organized manner. Consider using a dedicated file or digital record-keeping system. Having these details handy and organized will assist with tax prep, and it can provide valuable information to help your business grow.

3. Know what documents to file

In addition to your income records and expense receipts, you’ll also need specific tax forms based on your business structure. These documents help accurately calculate your taxable income, claim deductions and comply with tax laws. Most tax forms include worksheets to help calculate your tax liability.

If your car sharing income exceeds $600, you’ll likely receive a 1099 form from the car sharing platform. This should accurately reflect your payouts from the company. Compare that with your income records and ensure it matches.

To file your taxes, you’ll use one or more forms. Sole proprietors usually report their business income and expenses on a Schedule C (Form 1040). The forms an LLC uses depends on how they’ve chosen to be taxed. Corporations usually use Form 1120, while sole proprietor LLCs use Schedule C.

If you use your car for personal and business purposes, you’ll need Form 4562 to report depreciation and the business percentage use of your vehicle.

4. Claim business tax deductions on your expenses

Claiming tax deductions on your expenses is an effective way to reduce your taxable income and tax liability. These deductions usually relate to the operating costs of your business. They’re essential if you’ve purchased vehicles for the express purpose of renting to others.

Tax deductions on your taxable income

Business-related expenses for your car sharing business are generally tax-deductible. Here are some common expenses that you can deduct:

- Car maintenance and repairs: Costs associated with maintaining and repairing your vehicle, such as oil changes, tire rotations and brake repairs.

- Insurance: The portion of your car insurance that covers business use.

- Depreciation: This accounts for your car’s decline in value over time.

- Interest on car loan: If you have a car loan, the payment’s interest portion can be deducted as a business expense.

- Registration and licenses: You can also deduct fees paid for car registration and any required business licenses.

Don’t forget that every deduction you claim requires a detailed record and receipt.

Calculating expenses related to business use

If you’re using your car for personal and business purposes, you need to calculate the usage percentage for each. This is typically done in one of two ways:

- Actual expense method: Keep track of all your car-related expenses and then multiply by the percentage of miles driven for business purposes.

- Standard mileage rate: Multiply your business miles by the standard mileage rate provided by the IRS (65.5 cents per mile for 2023).

After calculating your total business-related car expenses, claim that amount as a tax deduction.

Tallying your taxable income

Your taxable income is your total income minus your tax deductions. For your car sharing business, this would be the total income from renting out your vehicle minus your deductible expenses.

For example, if you made $10,000 from your car sharing business and had $4,000 in deductible expenses, your taxable income would be $6,000.

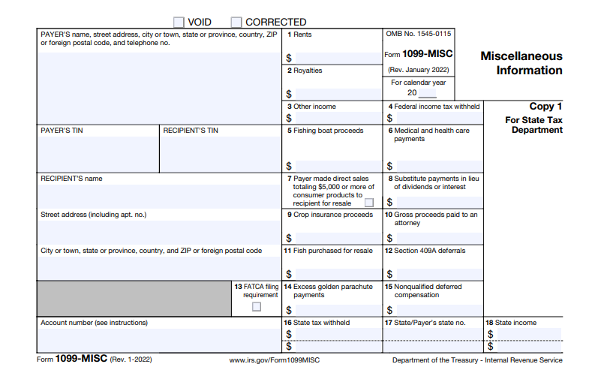

5. Learn how to read a 1099 form

We mentioned Form 1099-MISC above, but what is it? It reports various types of income other than wages, salaries or tips. Your 1099 form may resemble the sample below and include the following details:

- Payer’s information: At the top left of the form, you’ll find the name, address and telephone number of the payer — in this case, the car sharing platform.

- Recipient’s information: This section, located at the lower left part of the form, includes your name, address and taxpayer identification number (TIN).

- Account number: If you have multiple accounts with the payer, your account number will be listed here to differentiate between them.

- Boxes 1-2: These boxes are related to various types of interest income and dividends, which likely won’t apply to car sharing business owners.

- Box 3: This is one of the most important boxes for car sharing businesses. It reports nonemployee compensation, where your earnings from the car sharing platform will be reported.

- Boxes 7-15: These boxes pertain to various other types of income, such as substitute payments, crop insurance proceeds or excess golden parachute payments. Most of these won’t be relevant to car sharing.

- Boxes 16-18: These boxes are related to foreign taxes and foreign accounts, which may not apply to most car sharing business owners.

6. Understand vehicle depreciation

Vehicle depreciation is a significant factor to consider for tax planning. The IRS allows you to deduct depreciation from your taxable income to reduce your tax liability. You have two methods to calculate it:

- Straight-line depreciation: This method spreads the net cost of the vehicle evenly over its useful life span. For example, if you purchase a car for $30,000, anticipate a salvage value (estimated value after depreciation is complete) of $15,000 and expect the car to have a useful life span of five years, you would claim $3,000 ($30,000-$15,000, divided by five) as a depreciation expense each year until the value of the car on the books is $15,000.

- Modified accelerated cost recovery system (MACRS): This method allows you to deduct a larger portion of the net cost in the early years of the vehicle’s life (faster depreciation) and less later on. The IRS provides tables to calculate these amounts.

In year one, the depreciation limit is $11,200 for vehicles in service before September 27, 2017. For vehicles acquired afterward, the limit is $19,200.

Finally, once you start taking depreciation, you have to use the same method for the vehicle’s life span. For example, you can’t switch to the straight-line method after using MACRS.

Whether you claim depreciation depends on your circumstances. If the model of car you own loses value rapidly, then claiming depreciation can be beneficial. But if you sell the car for more than its depreciated value, you may need to pay taxes on the difference.

There are limits on how much you can claim in depreciation each year. If you’re interested in depreciation, consult a tax pro to understand how it can impact your tax situation.

7. Remember self-employment tax

A common mistake new entrepreneurs make (even if it’s just a side hustle) is forgetting to budget for self-employment tax. When you work at a company, your employer pays a portion of your Social Security and Medicare taxes. But when you’re reporting business income, you are responsible for the total amount.

The full self-employment tax rate is 15.3% — and that’s on top of your regular income tax rate. If you’re worried about a high tax bill, ask an accountant how much to expect to owe on your peer-to-peer (P2P) car sharing income.

8. Make quarterly estimated payments

If you make $1,000 or more each year in business income, you’ll need to make quarterly estimated payments. The IRS provides a guide to help calculate how much you should pay and when to avoid surprise tax bills or late payment penalties. Note that certain states may also have their own taxes to calculate.

Please note that the information provided does not, and is not intended to, constitute legal or tax advice. All information is for general informational purposes only. Readers should contact a tax professional to obtain advice with respect to any particular financial matters.

Frequently asked questions about claiming car rental business tax deductions

How can I deduct the cost of acquiring vehicles for my car rental business?

The cost of purchasing a vehicle for a rental car business may be a capital expenditure. You can’t deduct the entire cost in the purchase year, but claiming depreciation allows you to spread the net cost over several years based on the expected useful life of the vehicle. Contact a tax professional to learn more.

Are fuel and operating expenses eligible for tax deductions in the car rental business?

The cost of operating a vehicle you use for business activities (like car rentals), including fuel, is deductible. If you use the car for both personal and business use, you must split those costs accordingly.

Is there a depreciation deduction available for the vehicles in my car rental fleet?

The IRS allows you to claim a depreciation deduction for the vehicles in your rental fleet. You can do this using the straight-line method or the MACRS method.

What kind of documentation should I maintain to support my tax deductions as a car rental business owner?

Maintain detailed records and receipts for all your car rental-related expenses. This includes documentation for vehicle purchases, repairs, fuel, maintenance, insurance premiums, registration and the dates it was shared out and what the starting and ending mileage readings were for each trip.

Please consult with a tax professional to ensure you’re accurately tracking your expenses and taking full advantage of tax deductions.

Borrow & share

Avail makes it simple to borrow a car when you need one, or share your car with others and earn money.