December 22, 2023

Is renting your car out worth it?

Sharing your personal car through a platform or car sharing service is an excellent way to make money on the side. But the allure of going it alone and listing your car privately so you don’t have to share profits with a platform might be too tempting to ignore.

On paper, renting out your car without the help of a service might sound like a great way to maximize your earnings. However, there are trade-offs and risks to consider that might make it sound a little less appealing.

Let’s walk through the basic pros and cons of renting out your car on your own and how to mitigate some of the most significant risks.

Pros and cons of renting your car out

We’ve written about how to make money sharing your car through the lens of using a third-party service to help manage the biggest pain points of the process. We believe it’s the easiest way to do it. But for those with a little extra entrepreneurial spirit, be mindful of the following benefits and risks of doing business on your own.

Pros of renting your car out privately

- Maximize your earnings. When you manage everything independently, you can set your own rates while avoiding commissions and other fees that third-party car sharing companies may impose.

- Bypass vehicle restrictions. Car sharing companies have strict guidelines about the kinds of cars they accept for sharing. These guidelines may include the model year, type of vehicles and overall mileage. It’s possible that the car you intend to rent out doesn’t meet every listed requirement. But if you’re doing business on your own, you can determine what makes a vehicle eligible to be shared.

- Claim additional tax deductions. Operating your own business versus as a sole proprietor through a third-party car sharing service may offer additional benefits, such as different tax deductions, when it comes to state and federal income taxes. Consult a tax professional to learn the relevant details so you can make an informed decision.

- Build your own business. If your ultimate goal is to create a small business with its own brand, then this is the path you will ultimately want to pursue. However, it could be worthwhile to consider using a third-party service in the beginning. This will allow you to better understand the details and learn about the logistics required to make the business successful while not having to do the heavy lifting right away. Then after you’ve done your due diligence, you can start building your own company.

Cons of renting your car out privately

- Coordinating key exchanges. You must manage the process of setting up meeting places and dropping off the keys with each borrower. That includes potential safety issues of meeting strangers with your car.

- Vetting drivers. You must vet the drivers before letting them drive your car. This could include an extra cost to do a background check on each person, but at the very least means verifying that their license is legitimate and current.

- Managing damages, late returns and vehicle theft. When you are building your own business, without the help of a service, you will be fully responsible for things like damages — unless you have it written in a contract otherwise — as well as if the vehicle is late for another borrower or, in a worst case scenario, stolen.

- Preparing your car for the next borrower. You’ll need to manage cleaning and refueling, including communicating expectations to borrowers and charging penalties on those who don’t comply. You can either hire someone to clean your vehicle and go to the gas station to refuel, or you’ll have to spend time cleaning it to appropriate standards yourself.

- Paying extra insurance costs. Using your car for business purposes often leads to higher insurance premiums. Most personal auto policies do not cover using your vehicle for commercial purposes, and you may find yourself with an issue if your driver doesn’t have appropriate coverage as well.

- Protecting yourself legally and financially. As you set up your business, you’ll need to draft contracts, have the appropriate insurance and set up a payment system to ensure you can collect payments, bill for fines after the vehicle is returned and handle any disputes if borrowers come back saying they did not cause a particular type of damage to warrant the fee. Failure to have a contract, for example, could lead to expensive lawsuits such as determining who is responsible for paying automated traffic tickets or non-collision damage to your vehicle. It also exposes you to liability if someone crashes your car or hurts someone with it. You can either write the contract yourself or hire legal counsel to do it for you.

- Managing advertising and marketing. When you work with a third-party service, its already a well-known brand and is able to attract borrowers through its own marketing efforts. Additionally, the company will manage the promotion of your vehicle on its site and utilize an algorithm and promotional tools that enable them to maximize vehicle rentals. Starting your own company from the ground up means that it will take time — and a big monetary investment — to build brand awareness, trust and loyalty to the point of getting regular bookings.

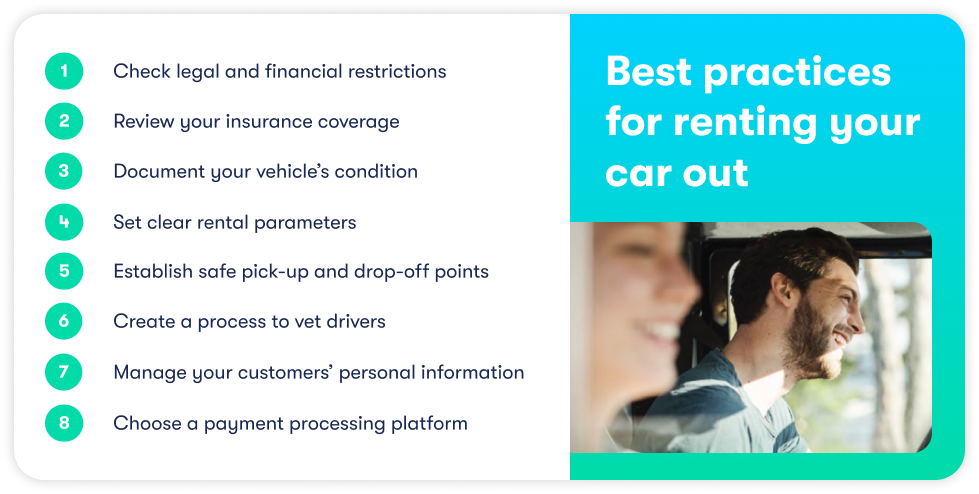

Best practices for renting your car out

If you’re considering renting your car out privately, take steps to protect yourself and your property. Follow these best practices for a smooth experience:

- Check legal and financial restrictions. Before you rent out your car, make sure that it’s legal to do so. If your vehicle is being leased or financed, your bank or lender may have restrictions against renting it out. Carefully read the terms of your agreement before you advertise your car for rent.

- Review your insurance coverage. Contact a licensed agent or your insurance carrier to make sure your insurance policy allows for peer-to-peer car rental. Some policies may not cover damages incurred during the rental period. You might need to upgrade your coverage to a commercial policy or find a specialized provider.

- Document your vehicle’s condition. Take clear photos of your car’s interior and exterior before and after each rental. This is essential for resolving damage disputes. If you think you’ve taken enough pictures, snap a few more just in case.

- Set clear rental parameters. Partner with a legal professional to define the rental period, mileage limit and rules (like no smoking) up front. Communicate these restrictions and regulations clearly to the renter, and ensure you have contract language to define consequences if they breach them.

- Establish safe pick-up and drop-off points. Choose safe and convenient locations for handing over your keys and car. You may be able to purchase and install remote access options to make the process easier.

- Create a process to vet drivers. Depending on your preference, this could be something simple such as running background checks for each driver to ensure they don’t have a history of DUIs or restricted licenses.

- Manage your customers’ personal information. You’ll need to use a secure system to keep your customers’ personal information safe from hackers or easily being discovered by others. That’s not just good advice, it’s a legal necessity for businesses.

- Choose a payment processing platform. You’ll need to choose a platform for your payments, whether that’s setting up something online on your website or managing it in-person with a smartphone or tablet and connected payment system.

While these best practices can help you manage renting your car out to others as a side hustle, another option is to research one of several car sharing services on the market.

Use a peer-to-peer car sharing service to rent out your private car

Avail reduces the friction of car sharing by handling most of the details noted above. You just choose the length of each listing period and which of our Denver or Chicago locations you want to share your car from. The only thing you have to do beyond that is drop off your car and pick it up. We handle the work from there — including vetting borrowers, promoting your vehicle on our platform, borrower communications, key and car exchange, managing inspections and post-trip cleaning and refueling — and getting you paid. Our car sharing insurance gives you peace of mind that you won’t be responsible for accidents that occur while your car is out of your possession, and we’ll manage claims on your behalf with your consent.

Frequently asked questions about renting your private car out

Can you rent out your personal car?

Yes, you can rent out your personal car, either through a peer-to-peer car sharing service or on your own. Sharing your vehicle can be an excellent way to help offset the costs of car ownership. Still, you should be aware of your auto lender’s and insurance company’s rules before you get started.

Is renting a car worth it as a side hustle?

Renting a car can be worth it as a side hustle, provided your costs don’t eat into your earnings. Make sure you know how much you can earn renting your car out and compare that with your car payment, insurance costs and other expenses. In some cases, you may receive guaranteed payouts even if your car isn’t booked by a driver, such as the $50 you earn when you share your car for seven consecutive days on Avail.

What are the drawbacks or disadvantages of renting my personal car to others?

The most significant drawbacks or disadvantages of renting your car to others privately include navigating contracts, insurance and scheduling independently. You must set clear policies and rules for people who rent your car. You also need to have enforcement mechanisms in place. Otherwise, what’s to stop someone from smoking in your vehicle, returning it damaged or even stealing it?

Using a service like Avail to share your car with others makes billing, cleaning and maintenance as simple as possible, and ensures safety for all parties.

Borrow & share

Avail makes it simple to borrow a car when you need one, or share your car with others and earn money.